Our Maritime Lien Filing and Recording Service provides anyone (in any State) the ability to claim money owed to them from a U.S. Coast Guard Documented Vessel. The vessel is usually NOT in their possession. Additionally, the money owed to them is for a past due balance.

What is a Maritime Lien?

The best way to explain a maritime lien or documented vessel lien is to describe what it is used for and why. A maritime lien is a claim of lien placed on a Vessel by someone “claiming” they are owed money that hasn’t been paid by the vessel owner. The maritime lien balance could be for things like wages, labor, repairs, general services, fuel, parts, etc. These vessels do not have titles so aren’t governed by a State. For example; Most smaller boats used for recreational purposes, have a certificate of title. They are titled, registered and governed by each State’s Department of Motor Vehicles. Larger Vessels such as commercial fishing boats do not, they are governed by the U S Coast Guard (federally)

The best way to explain a maritime lien or documented vessel lien is to describe what it is used for and why. A maritime lien is a claim of lien placed on a Vessel by someone “claiming” they are owed money that hasn’t been paid by the vessel owner. The maritime lien balance could be for things like wages, labor, repairs, general services, fuel, parts, etc. These vessels do not have titles so aren’t governed by a State. For example; Most smaller boats used for recreational purposes, have a certificate of title. They are titled, registered and governed by each State’s Department of Motor Vehicles. Larger Vessels such as commercial fishing boats do not, they are governed by the U S Coast Guard (federally)

A documented vessel has a Certificate of Documentation instead of a certificate of title.

The U.S. Coast Guard National Documentation Center governs a documented vessel because they meet one or more of the following requirements:

- Firstly, Bear five net tons or more

- Secondly, Are used in fishing activities on navigable waters of the U.S. or in the Exclusive Economic Zones (EEZ)

- Thirdly, Are used in coast-wise trade

Where Is A Maritime Lien Recorded?

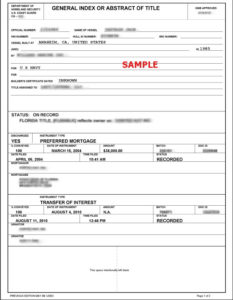

All maritime lien records are in General Index or Abstract of Title. This is basically a record or documentation of sales and liability activity by the U.S. Coast Guard Documentation Center.

The vessel’s name, official U. S. Coast Guard Number, HIN number, manufacture information and port information is initially recorded. Then, bill of sales, loans, maritime liens and lien satisfactions are recorded on there throughout the vessels life. It’s different from a Certificate of Title because when someone purchases a boat or vessel and gets a loan, the DMV records the finance company’s loan on the Certificate of Title as a lien with a lien-holder.

A documented vessel with this Certificate of Documentation loan is referred to as a “Mortgage or Preferred Mortgage”. In addition the “Mortgagee” is also referenced as the name of the bank or financial institution that loaned the money to the vessel owner. (instead of lien-holder)

Filing and Recording a Maritime Lien can benefit you because the owner or manager of the vessel will have a problem acquiring a new loan or selling the vessel when there are liens on it. Consequently, the owner of the vessel will usually want to work with you to get the claim of lien paid off, so it shows as satisfied on the vessel’s record. Financial Institutions do not like to loan money to vessels with liens.

Testimonials

Maritime Lien vs Labor, Service, Storage Liens

The Maritime Lien allows the claimant to put a lien against the vessel's Certificate of Documentation. The claim of lien is listed on the abstract of title paperwork after the U S Coast Guard approves it. The lien notation remains on record until the coast guard receives a lien satisfaction from the claimant.

Liens Governed by a State such as Florida for Labor, Service or Storage charges are for vessels in the lienor's possession (storage yard, marina, vessel repair shop, etc) and are approved by the Department of Motor Vehicles. The lienor 1st follows certain procedures to apply for a transfer of certificate of title for non payment of their claim of lien.

A maritime lien just goes on the vessel's record as long as the paperwork is done correctly but it can be enforced by an Attorney that specializes in that type of litigation.